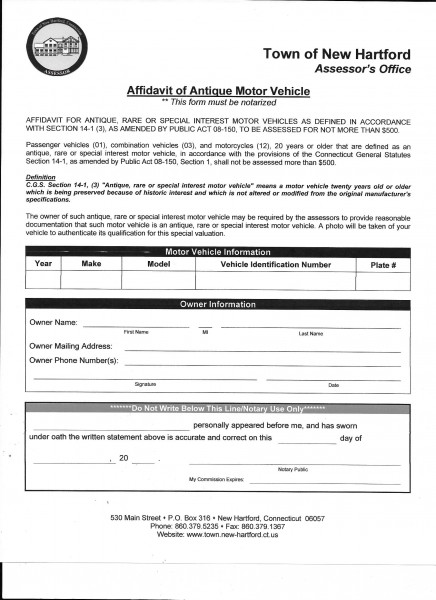

HARWINTON, CT – It was during a breakfast conversation yesterday with friend and rider Neil Tolhurst of New Hartford that I became aware of a law  that I subsequently discovered has apparently been in effect in Connecticut for seven years. It states that “passenger vehicles, combination vehicles and motorcycles, 20 years or older that are defined as an antique, rare or special interest motorcycle vehicle … shall not be assessed more than $500.”

that I subsequently discovered has apparently been in effect in Connecticut for seven years. It states that “passenger vehicles, combination vehicles and motorcycles, 20 years or older that are defined as an antique, rare or special interest motorcycle vehicle … shall not be assessed more than $500.”

Tolhurst reported that he’d recently gone down to town hall to fill out a form declaring some of the iron in his garage qualified. My property tax bill(s) arrived last week, and his comments got me wondering if I was overpaying for my 1983 Yamaha XT250.

Upon getting home, I checked the bill and discovered that the Town of Harwinton has the 32-year-old enduro assessed for $950, nearly double what the law states is proper.

While the XT250 certainly isn’t “rare or special interest,” it is an antique – even if it doesn’t have a “Classic Motorcycle” license plate on the rear.

Today, figuring that more investigation was needed, I went to New Hartford’s website, found the form that Tolhurst had mentioned and printed it out. I then drove to Harwinton Town Hall to see if a similar form was available.

Before getting to the assessor’s window, though, I bumped into the town’s tax collector and told her of my mission. She was aware of the law. However, that wasn’t the case when I spoke with a clerk in the assessor’s office a few minutes later. She had no form to give me and was unaware of the law that seemingly prohibits an assessment of “more than $500” on antique vehicles.

We chatted pleasantly, she asked if she could copy the form from New Hartford that I’d brought along, and speculated that maybe only vehicles with vintage plates could get the reduced assessment; that coding from the state Department of Motor Vehicles would automatically make the town assess correctly. She said the town’s assessor would be in the office on Tuesday and to check back.

After returning home, I called Tolhurst to tell him of my experience. He said the form must be filled out every year if you do not have a classic plate, but that if you have a classic plate, you only have to fill it out once to get the assessment break.

I’m wondering just how many hundreds or thousands of owners of registered old motorcycles are paying more in property taxes than they are required to by law. I’m not suggesting that towns across the state are purposely ripping off their residents, but I am speculating that owners are possibly being hit up for an excessive amount through lack of knowledge – either on the part of assessors offices or the owners themselves.

The 2015 tax that Harwinton wants to collect on my XT250 is $25.94. That’s possibly more than a $10 cash steal. So how many thousands of dollars are vintage bike owners in the state surrendering unknowingly? And not just motorcycle owners. This is also quite likely true for all other owners of old vehicles.

If you own a vintage motorcycle and your tax bill just came, I suggest that you inspect what it’s assessed for and then take action.

More investigation is warranted.

Ride CT & Ride New England Serving New England, NYC and The Hudson Valley!

Ride CT & Ride New England Serving New England, NYC and The Hudson Valley!

Oh wow! This is a great article. I hope lots of people see this for the savings.