How a motorcyclist views the current state of the motorcycle industry may depend upon the brand of bike a person owns and/or on their loyalty to a specific brand. If a rider’s brand is doing well, that person might think all is rosy. If the opposite is true, concern might be intruding, unless that person is victimized by blind allegiance and is in denial. It’s akin to today’s political situation.

Does a Honda owner ever wonder or even consider how Japan-based Honda is doing as a company? What would be the purpose? Hondas are well made and reliable, if sometimes unimaginative or quirky when it comes to styling, but they have a good bit of heritage. The brand’s Gold Wing touring model is celebrating its 50th anniversary this year.

To keep the political analogy going, Honda’s a bit like Canada. Huge, steady, dependable, and rarely boisterous or in the glare of the spotlight. It’s a wallflower make that dealers sell and owners ride without bringing attention to themselves.

Crucial elements in Honda’s success are the breadth of product and pricing. An entry-level Rebel 300 or CBR300R starts at under $5,000, while a Rebel 1100 cruiser begins at under $10,000. A Gold Wing 50th Anniversary starts at $25,200, which seems in line with the bulk and purpose of the product, not an example of price gouging. The most expensive Gold Wing starts a $29,200. Repeat that number and remember it as a point of reference.

Honda has nearly 40 street models, including touring, cruiser, standard, sport, adventure, dual sport and mini offerings. More are on the way. Hondas tend to bring smiles and revive memories. No matter one’s riding preference, a modern-day Honda Super Cub C125, which retains the shape it did when the Cub line started in 1958, always looks like it would be fun to bimble around on.

Honda somehow gets overlooked when the conversation turns to motorcycles, though, yet it sold a whopping 19.6 million units worldwide in 2024, an increase of six percent from 2023.

Repeat that number, too, to get the full impact – 19.6 million.

As far as worldwide sales of motorcycles in 2024, some 61.8 million models exited showrooms, an increase of 2.7 percent over 2023, while total sales in the U.S. were down 1.7 percent to 553,325.

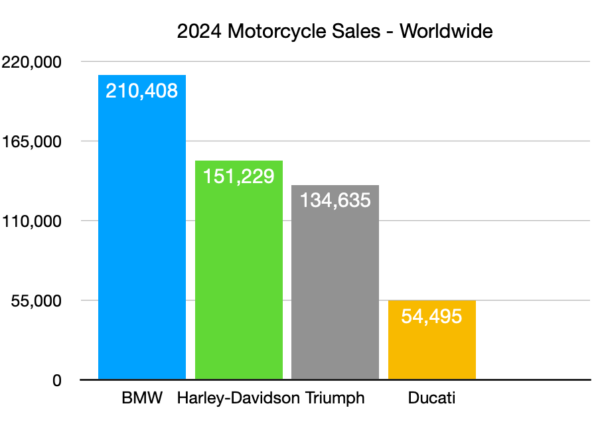

Honda’s sales of 19.8 million units was staggering compared to the dwindling number Harley-Davidsons sold last year – a total of 151,229, a seven percent drop from 2023. More on Harley-Davidson to come…

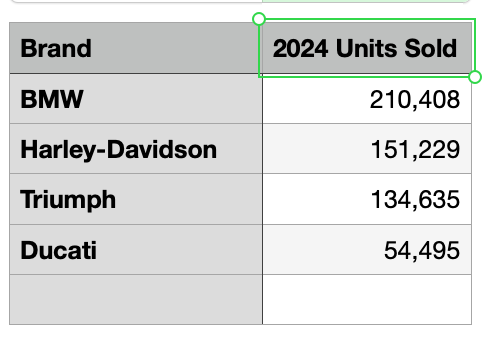

Germany’s BMW sold many, many more models than Harley-Davidson, too, and a surging Triumph from England came within the neighborhood of the American make. An argument can also be made that specialty sport brand Ducati from Italy did better proportionally.

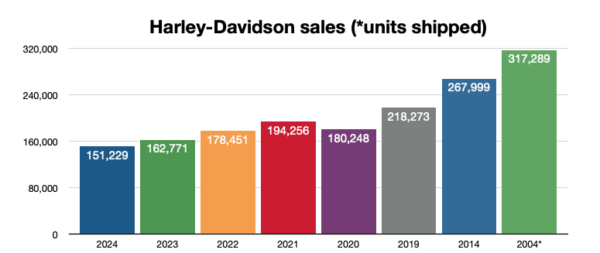

BMW had worldwide sales of 210,408 models in 2024, which the company claimed was the “strongest sales result in company history,” although it was only a minor uptick from 2023. Comparing the numbers, BMW sold 39 percent more bikes than Harley-Davidson, according to RIDE-CT’s resident statistician, Bob Rosen.

Hard to imagine? Or not?

BMW’s U.S. sales in 2024 totaled 17,272, a slight increase from the 17,017 units that exited showrooms in 2023 and a slight decrease from the 17,690 sold in 2022. The brand’s relatively flat sales here can no doubt be traced to the size of its dealer network and its high-end appeal. A base model K 1600 B touring model has an MSRP of $23,385.

Owners of BMWs often grouse that the brand’s models are over-engineered, are too complicated and cost an excessive amount to service and maintain. Nonetheless, BMW enjoys tremendous brand loyalty. And with nearly 40 models covering a broad range of types and engine sizes from 313cc to 1,802cc, the brand offers a model and style for nearly every rider.

Looking at the top-end BMW touring model, the K 1600 GTL with a base price of $27,745 (which is $1,455 less than the top Gold Wing), which would you buy? Given Honda’s track record with the Gold Wing, it might be easier on the nerves and better on the wallet in the long term to spend a bit more up front.

Shifting to Triumph, this brand’s recent rise has been dramatic. Global sales in 2024 were 134,635 units, a 64 percent increase from 2023 and a 123 percent rise from only five years ago. Triumph is now in striking distance of Harley-Davidson thanks to diversity, quality and, like Harley, an iconic name.

Triumph offers more than 37 models in various categories (distinct and variants) from 398cc to 2,458cc. Like Honda and BMW, Triumph aims to reach as many potential buyers as possible.

—

Even the performance-oriented niche brand Ducati from Italy, which had sales of 54,495 units worldwide in 2024, appeals to sport, touring, dual sport and, ahem, cruiser enthusiasts. It also has high after-purchase costs, which may deter some from buying.

Cruiser-heavy Harley-Davidson, meanwhile, is flying a hurricane flag. It offers 22 models – but really fewer if variants are factored in – and four of them are premium-priced models. The CVO versions of its Grand American Touring models start at $44,999 – a hefty $17,254 more than a BMW K 1600 GLT. That’s not a typo. The CVO example of its Pan American adventure touring model begins at $29,249.

While BMW’s sales in the U.S. were up 255 units from 2023 to 2024, Harley-Davidson’s sales in its homeland dropped significantly, from 98,468 in 2023 to 94,930 last year. That’s a decline of 3,538 units.

The least expensive Harley-Davidson model is the Nightster starting at $10,499, one of three “small” models using the company’s smallest 975cc engine. Lacking sport, dual sport and entry-level models – or, more crucially, any model under $10,000 – narrows the brand’s focus and puts Harley-Davidson at a competitive disadvantage.

—

Not to repeat the gist of other stories about Harley-Davidson on this website, but the company’s tilt in recent years from being a mass appeal brand to premium boutique status, while perhaps being logical at the time, may ultimately steer it to irrelevance or the graveyard. Sales have long been in decline; the only aberration being 2021, which followed the COVID year of 2020. The only beneficiaries when it comes to Harley’s strategy are in the C-suite.

With limited types of motorcycles, premium pricing and a shrinking core customer base, Harley-Davidson perhaps needs more than a niche strategy to prevail in the years ahead. Yes, it only sold 4,535 examples of its Pan American adventure touring models last year, down from 5,128 in 2023. That’s makes the model a dud. Would the result have been the same had Harley-Davidson proceeded with plans for a sport bike called the Bronx a few years ago? Maybe not.

The cruiser market is moribund. Adventure bikes sell, and an argument can be made that the Pan American failed largely based on bulbous, top-heavy looks. Sport bikes and small, affordable city bikes like Honda’s Grom lure younger riders and urban dwellers. The guess here is that the Bronx would have brought in new customers to replace those now buried? It’s not too late for Harley-Davidson to find out.

No matter one’s brand, the motorcycle industry is facing uncertainty. The Austrian-brand KTM is trying to escape bankruptcy, placate creditors while escaping $1.36 billion in debt, and unload a year’s worth of inventory. Dealerships are closing here in Connecticut (and elsewhere). And, with the current administration in Washington producing headlines on a daily basis that leave everyone wondering what’s next, the future is hard to predict.

Between tariffs, interest rate concerns, and the unknown of what direction the economy might turn, the future for the motorcycle industry has more question marks than answers, except possibly for those manufacturers who have cast their nets wide and set prices equally broad.

(Photos courtesy of Honda, BMW and Harley-Davidson.)

Ride CT & Ride New England Serving New England, NYC and The Hudson Valley!

Ride CT & Ride New England Serving New England, NYC and The Hudson Valley!